We ought to do our due diligence in the Watts case, and figure out the finances. How was responsible for what? What financial storms were barreling over the Colorado plains that summer for this picture-perfect family from North Carolina?

As an initial point, in the 2015 Bankruptcy Filing, under the heading DEED OF TRUST FOR PRINCIPAL RESIDENCE, a black rectangle censors out a space. Does the blacked out space cover one name or two?

I know something about economics, but I don’t claim to be an expert on the subtleties behind income statements and balance sheets. Over the past few days I’ve approached three expert friends of mine – an accountant, a banker and a guy with a successful debt collection business – and asked them to prognosticate on the Watts family finances, including the 2015 Filing. I’m still waiting to hear back from all three of them. Other people’s money, it seems, is seldom as simple, straightforward or easy as it looks.

While we’re waiting for the experts to pronounce on those finances, let’s begin by stating the obvious in three areas:

1) What did the Watts themselves believe about their financial ability? 2) How were they living in 2018 compared to 2015 [during their first bankruptcy filing]? 3) What are the relative histories of Shan’ann and Chris Watts towards money and debt over time?

https://youtu.be/a6VSTvEGpfs

1) What did the Watts themselves believe about their financial ability?

Shan’ann uses the same language over and over again in all her promotional videos. A product is seriously “amazing” and “incredible”, we’re told, and her fellow promoters breathlessly repeat the same empty aphorisms. We never really find out why Thrive is such a gamechanging life changing product. As amazing as it is, it’s amazingly thin on facts, stats and real information, and incredibly fat on fancy packaging, branding and promotion.

There are endless character witnesses just like Shan’ann telling the world of Facebook – anyone dumb enough to listen – how amazing they feel, how good they look, what cars they’re driving, what holidays they took and of course what to do to join the Thrivin’ to make it all a better world for everyone.

The product [like the money in this game] is just a byproduct to living the Thrivin’ fairy tale. Nobody really cares about the product on their way to financial wellness. Well, only in a fairy tale business is the product itself a fiction and a fairy tale, and only real world flakes invest in fictitious finance.

During the above call Shan’ann refers to someone on her team earning a $200 000 bonus, someone else a $1 million bonus. These massive sums are presumably amounts extra over commissions, incomes and salaries. If so, it seems being part of the Thrivin’ thing means being awash with cash, doesn’t it?

So why wasn’t Shan’ann cash flush two years into her swim in the MLM Kool-Aid? Or was her marriage in trouble not because of financial strain, not because of the enormous debt they still carried three years later, but other factors?

Let’s consider for the moment that their finances were going down the drain. Being involved in MLM tends not to be a success story for 99% of people who do get involved, so the idea isn’t far-fetched.

The massive cash payouts Shan’ann was referring to in the clip above sounds and feels almost like a lottery, doesn’t it. Is it performance based or random?

Where this phantom money is supposed to come from is beyond me, but to MLM it doesn’t manner. The pyramid will fart it out. Who cares about the marginal economics of patches and powders, or how many of these bandaids must be actually purchased and recycled by those drinking the Kool-Aid to produce an excess – who cares about that when what matters is getting the bonus!

The extent of Shan’ann’s “investment” if that’s the word, in MLM provides some idea about just how poor her grasp was of business, economics, income or simply making ends meet.

If Shan’ann was drowning in Kool-Aid, Chris Watts was also taking glugs and gulps at the font of the barrel. If he wasn’t drunk on the Kool-Aid, he was certainly susceptible to its hypnotic pull.

The Watts family were in a real sense the intellectual inheritors of the housing bubble. In other words, they believed wealth could be conjured [like bubbles] out of thin air. Straw woven into gold with a few careful chosen words/incantations on social media.

The problem with bubbles is the same problem with fairy tales – when they pop, you find yourself in the real world, but this time the wolf barking at the door is real.

https://youtu.be/fkrUWWW7zqc?t=198

2) How were they living in 2018 compared to 2015?

In the video clip above Shan’ann appears to say [at about the 5 minute mark] that “they” have donated $500 000 to breast cancer awareness over the past two years, and are “shooting for” $500 000 “in this year alone”. What she means is the entire company has donated money. In 2015 Le-Vel donated $250 000 to the National Breast Cancer Foundation via the proceeds of it’s “Limited edition breast cancer DFT” [whatever that is].

I haven’t been able to find any further evidence of additional donations to Breast Cancer Awareness besides this. If there are, drop me a line in the comments below.

The point is, the donation isn’t really anything else besides the company using it’s own promoters to raise money for charity through their own sales to one another “for a good cause”.

If the Watts family were Thrivin’ in 2017 and 2018, had they been able to address their debt burden, or had it gotten infinitely worse?

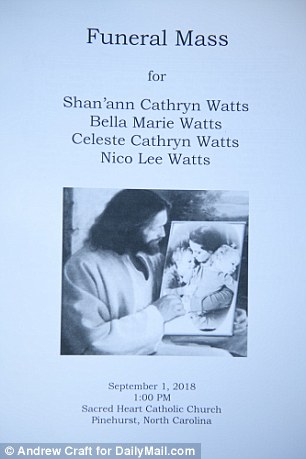

We don’t need an intimate knowledge of their finances to know that three years after filing for bankruptcy, it may not have been the best idea to have a third child. The original bankruptcy filing noted as much, stating in 2015 that the financial conditions of the family were likely to worsen after 2015 as Shan’ann was pregnant with her second child.

It should also be noted that Chris was driving a fairly beat up old truck in 2018. Hadn’t he qualified for a luxury auto bonus somewhere down the line? So why was he stuck in 2018 driving a company car, a fleet vehicle?

3) What are the relative histories of Shan’ann and Chris Watts towards money and debt over time?

This is the critical question. In a prior post we saw the backstories of Shan’ann and Chris Watts, and the sort of home they grew up in and lived in over the years. Shan’ann’s from a humble background. Her mother is a hairdresser, her father and brother are carpenters. Chris Watts is a mechanic from humble roots too. So how was money conjured into a $400 000 mansion on spiffy Saratoga Trail?

Now, remember that blacked out rectangle we looked at a moment ago? According to research done by one commenter on this site [thanks Cheryl]:

In terms of deed information the header for 2825 Saratoga reads:

“Two deed records were found on this property.” Underneath that header in this order is the following information:

Ownership Change: June 4, 2013

From: Christoper L. Watts to Christopher L. Watts and Shanann Watts (there is no loan information here, indicating the property was not refinanced; the June 4 activity indicates the addition of Shanann’s name to the deed only.)

Ownership Change: May 1, 2013

From KDB Homes, Inc. to Christopher L. Watts

Lender: DHI Mortgage

Loan Amount: $392,709

Lender Type: Mortgage Company

Loan Type: Federal Housing Authority (FHA)

Line of Credit: 0 Credit Line

Given what we know about the North Carolina house she owned and her selling it with all the furnishings, I would have to think she was in significant financial trouble (probably behind on mortgage payments) and couldn’t qualify for a loan…in 2013, when lending had really tightened due to the housing debacle. Assuming Chris’s credit was good, they probably had a better chance of obtaining a loan under his name only. Perhaps the idea was to jointly refinance the home later on, so that Shanann would be on both the deed and the loan. Since their finances went downhill after 2013, I imagine this was not a possibility. They certainly couldn’t take advantage of the rock-bottom interest rates that were available around the time they filed bankruptcy.

…What’s interesting about this is I think you can be on the deed without having to be on the loan, which means Chris may have been solely responsible for the loan while Shan’ann enjoyed half ownership of the house without the financial responsibility.

As their finances unraveled resulting in the 2015 bankruptcy coupled with what seems like continuing financial problems after that, the birth of two children, Shan’ann’s quitting her job to stay at home with the kids, unreliable income from Thrive, and then a third child on the way, I can only imagine the level of rancor this created in the Watts household, especially with Chris. It would also support Chris’s possibly having a sense of entitlement (literally and figuratively) to the home, thereby underscoring Chris’s wanting sole possession of 2825 Saratoga as a primary motivation for the murders. On the other hand, if Chris had no way to retain the home, his murdering Shan’ann could have been revenge for losing the home and compromising Chris’s credit–Chris had mentioned to a neighbor they were considering selling the home. Anyway, something to think about..

There’s also a third possibility. By getting rid of the straws that were breaking the camel’s back, Chris Watts may have figured he could cut his losses and replace his family [especially his wife] with a more viable family. Perhaps he could move in a girlfriend who had a half-decent paying job like his, and together they could get real about keeping the dream house and at least have a chance in paying it off.

In the post unequally yoked I touched on this aspect. The money train, debt and the idea of being yoked isn’t as sexy, apparently, as reading about a mistress. Like Shan’ann, the mistress may have been a means to an end, the end being keeping the fairy tale going at all costs. For Chris Watts the fairy tale was the house, not what was in it.

Recent Comments