While researching TWO FACE ANNIHILATION it’s become more and more obvious what’s missing from the Second Confession. The word “finances” appears just once, on page 17 of the CBI Report.

Ever since he sold his 4-wheeler for less than what he owed on it, Shan’ann wouldn’t let him do anything with their finances.

The word “debt” appears on the same page which deals with the cops quizzing Watts directly about the business of selling the house. Also a single instance of that word.

Most of the bankruptcy dealt with credit card debt from their wedding.

The word “money” also appears only one time on page 21.

His mother initially believed his father was having an affair because he couldn’t account for missing money.

Many are uncomfortable assigning blame – one way or another – for why these horrific murders took place. Are we less uncomfortable assigning blame for the financial mess they were in?

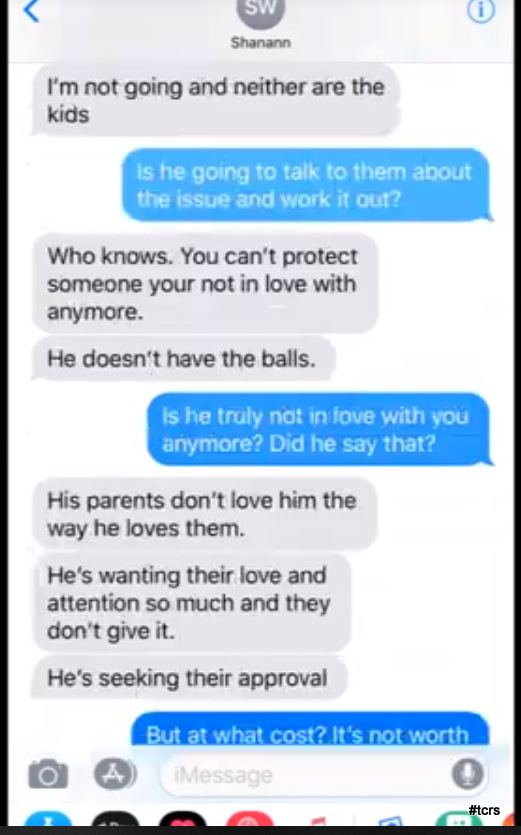

Although it’s clear Watts didn’t take much if any responsibility for his own finances [and only he is to blame for that], the fact that Shan’ann took control didn’t make matters any better. It also seems having gone bankrupt once before hadn’t been much of a check on whatever was going wrong behind-the-scenes.

Personally I don’t think it’s helpful taking sides in the financial equation either, as regards the Watts. Whether we say it was all Shan’ann’s fault, or all his fault, or that they were both at fault, the fact remains that a financial malaise appeared to hang over them – like a dark cloud – from as early as the beginning of their marriage. Why?

What seems to me to be more helpful is to understand how human psychology, with all its flaws and idiosyncrasies, plays into a pattern that adds up either to financial gain or ruin. It also seems reductionist to simply blame MLM. How is it to blame?

Today on a television show dealing with budgeting advice, I caught a clip by Maya Fisher-French, an award-winning financial journalist, that I thought really resonated with the Watts story.

Fisher-French was making a simple but profound observation about how human psychology plays into our approach to money through our sense of fulfillment, and overall gratification.

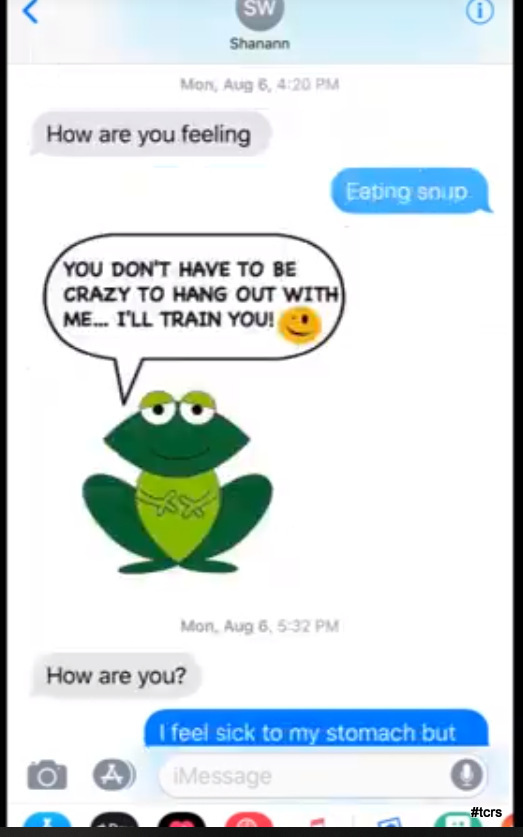

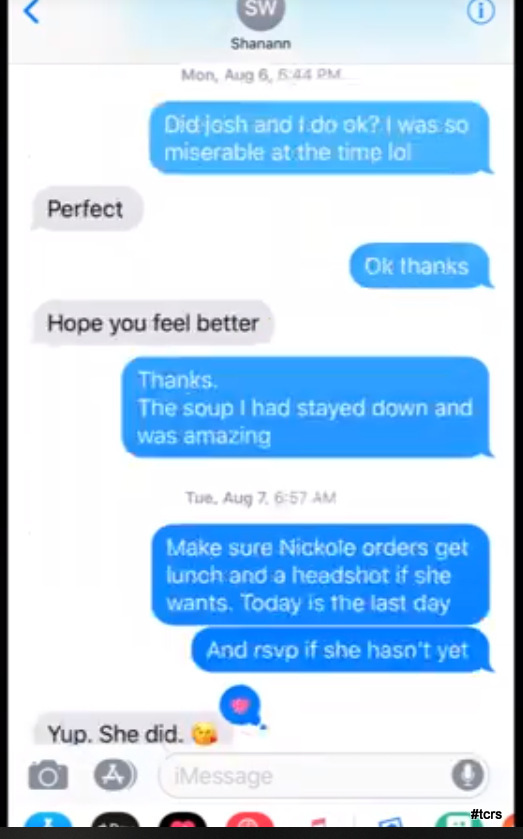

Her point was that when we try to save, we tend to focus on denying ourselves small things. We may scrimp on a latte, or hold ourselves back from buying a candy bar. We may – like Shan’ann – elect to choose a cheaper meal at a cheaper restaurant.

Fisher-French’s point is that when we reward ourselves, we do so disproportionately, spending thousands on a holiday, or hundreds on new outfits.

We can see how the Watts household was geared towards making small savings in certain areas [order your free Thrive pack today, at a discount], while splurging in other areas: a really big house, an expensive car, one exotic holiday after another.

The damaging thing about MLM is that it encourages exactly these enormous extravagances, and links them to the idea of “Thriving”, and having a better sense of self.

It even reverses the idea of saving in small doses by overpricing their products, and then simultaneously offering “unbeatable” bargains and discounts.

MLM’s message is you can live in a castle! You can have the luxury car! You can travel to your heart’s content! Don’t let anything [like not being able to afford it] stop you because you deserve it!

Fisher-French’s advice is to make a list of those things we deny ourselves on a daily basis that “hurt”, like that extra spoon of sugar in our coffee, or a dessert at a restaurant, and swap that around with our unworkable and unaffordable reward system.

She recommends saving on the big things rather than scrimping on the little ones as a more effective way of staying financially safe and sound. The idea is to connect our sense-of-self to daily, ordinary things, rather than to attach ourselves to bigger, unrealistic extravagances. In other words, financially we need to occupy and live in the real world.

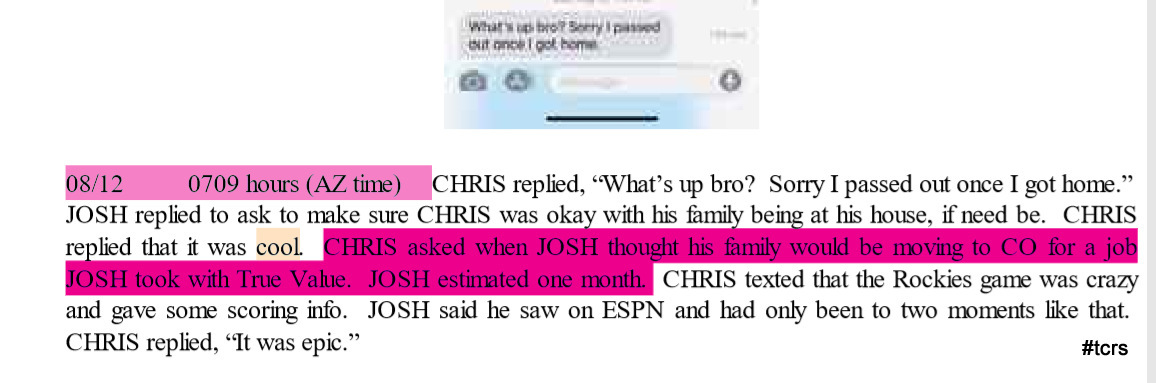

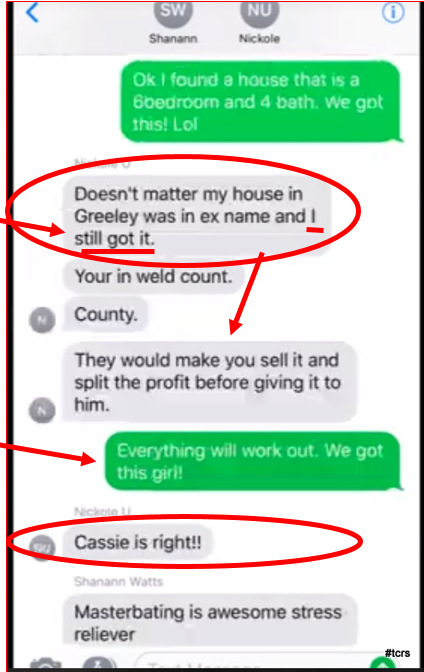

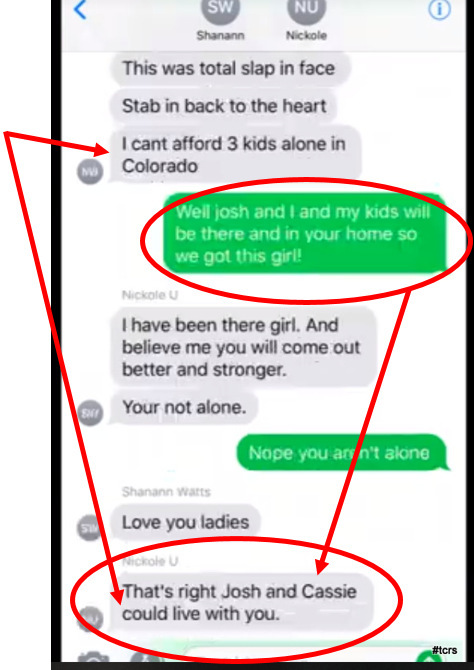

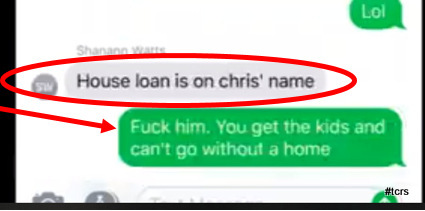

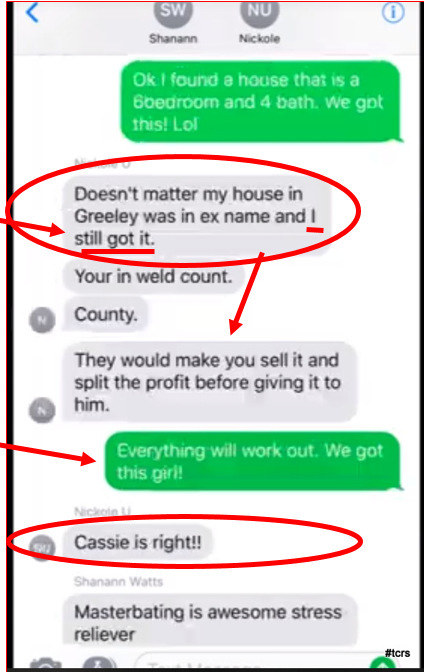

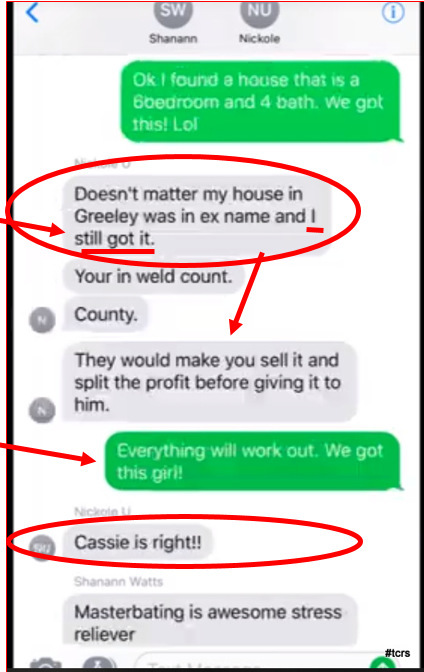

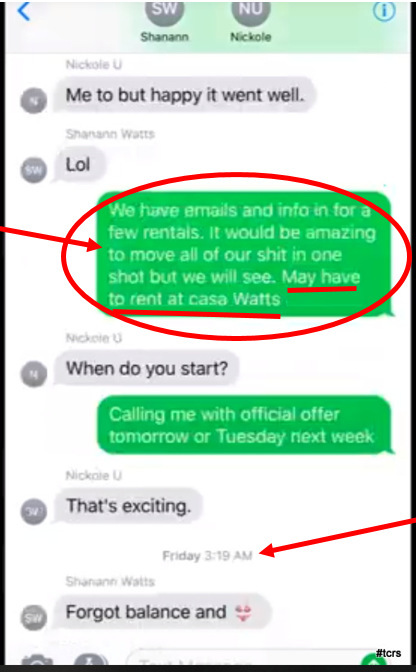

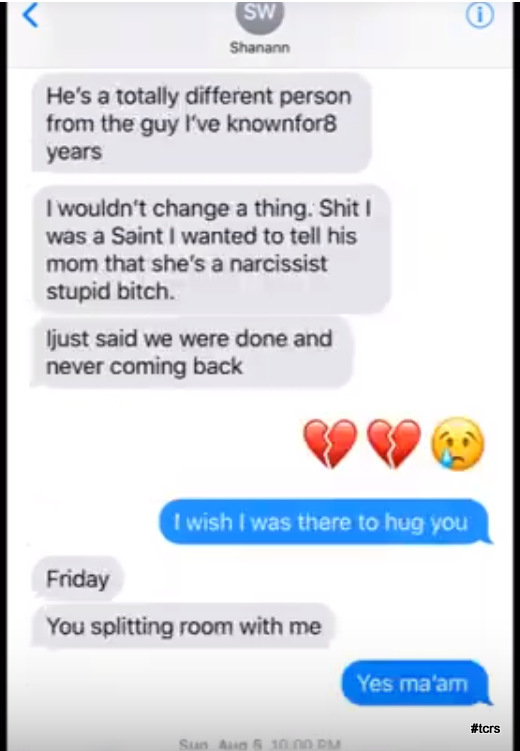

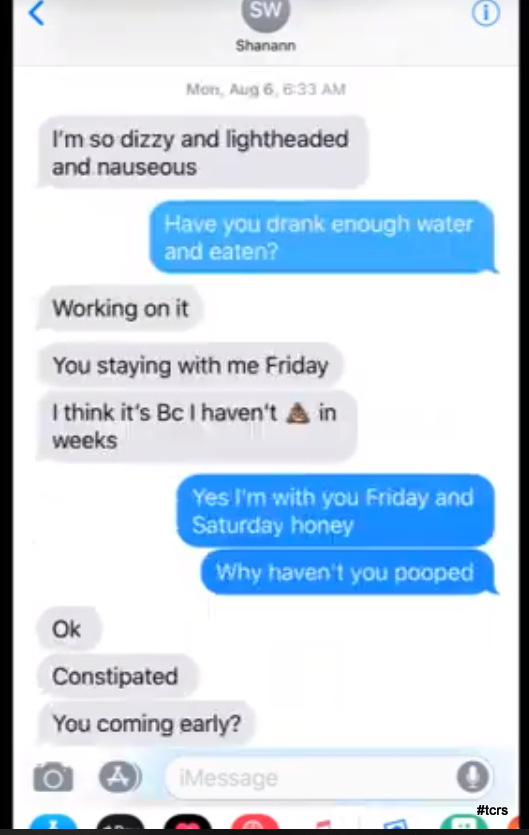

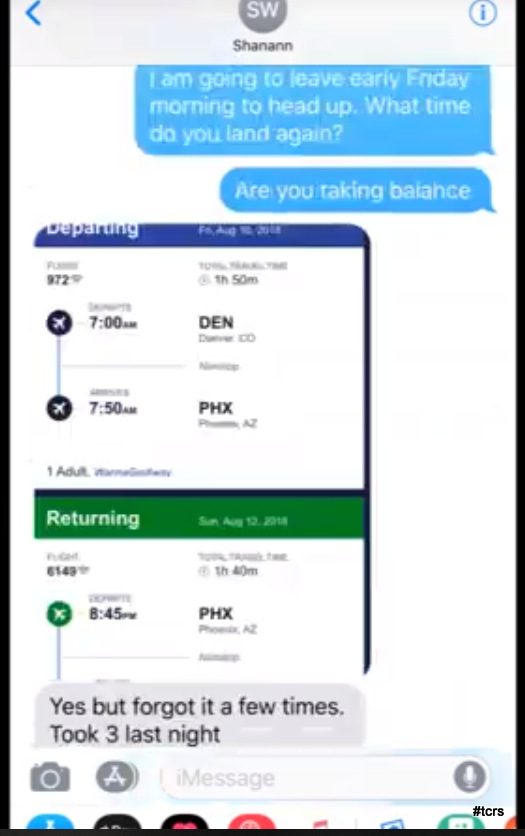

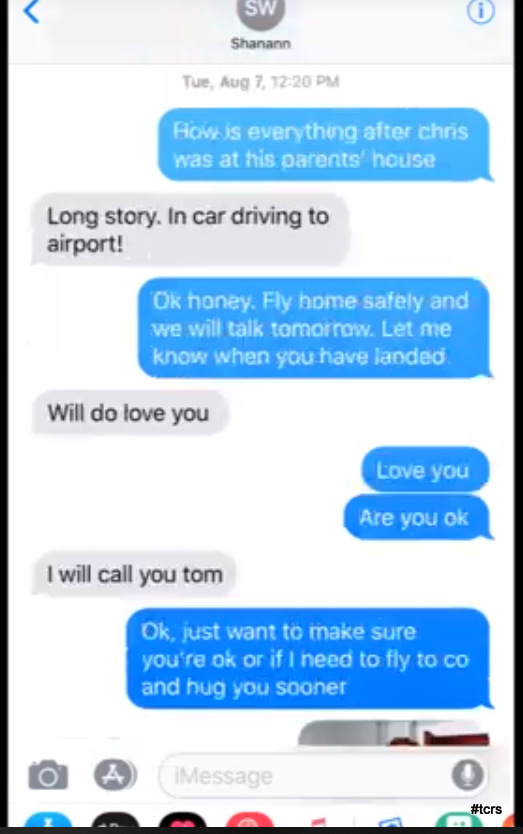

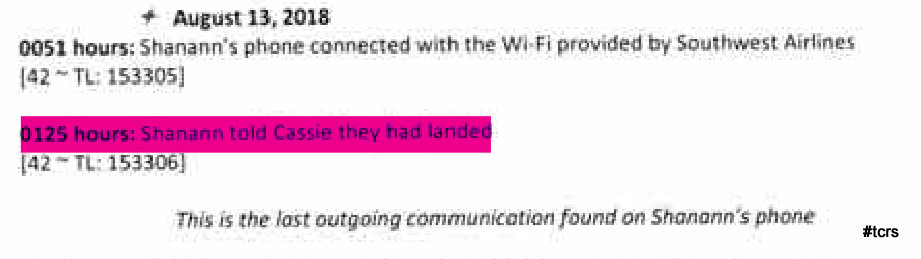

So in 2018, when they were scraping the bottom of the barrel again, there was an easy solution in the offing. Do what she’d always done. Move someone in and piggyback until things improved.

So in 2018, when they were scraping the bottom of the barrel again, there was an easy solution in the offing. Do what she’d always done. Move someone in and piggyback until things improved.

Recent Comments